The IRS is telling me that my continuing education is incomplete, and

that I still need to take the AFTR course. I thought I finished my CE

with you guys. Can you fix this for me?

Are You Being Shown This Screen on Your PTIN Account?

Students who have completed our 20-hour continuing education program often see this screen. Please continue reading this article to understand why the IRS is asking you to complete the AFTR course and additional education.

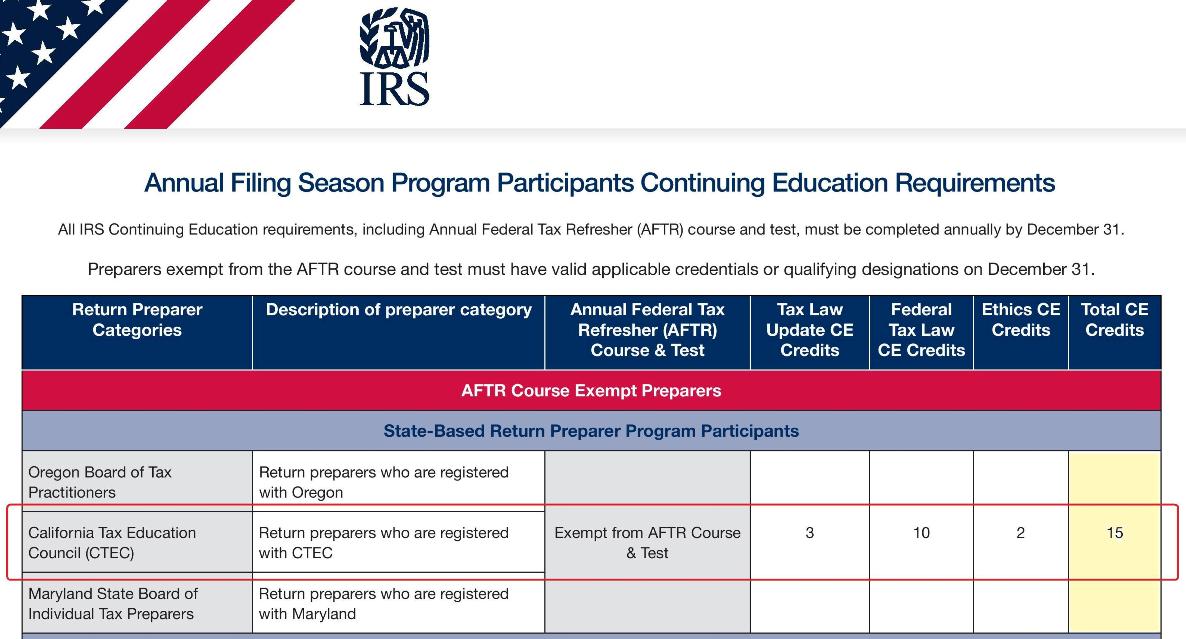

CTEC and the IRS Have Different Educational Requirements

Many of us will think that the IRS requires the same number of CE credit hours as CTEC. It turns out that the IRS does not have a state tax law requirement. Unlike CTEC (a state agency), the IRS (a federal agency) does not require you to take a 5-hour course on California tax laws. To qualify for AFSP benefits, CTEC-registered tax professionals (CRTPs) need to complete 10 hours of federal law, 3 hours of federal update, and 2 hours of federal ethics -- the sum of which is 15 hours.

AFTR Course

The majority of tax preparers in the United States do not possess a professional credential and need 18 CE hours to qualify for AFSP benefits. In addition to 10 hours of federal tax laws and 2 hours of ethics, non-credentialed tax preparers must complete a 6-hour Annual Federal Tax Refresher (AFTR) course.

CRTPs are Exempt from the AFTR Course

Tax professionals with a CTEC credential (CRTPs) can qualify for AFSP benefits without taking the 6-hour AFTR course. Please take a look at the IRS chart below [Source: https://www.irs.gov/pub/irs-pdf/p5646.pdf]:

For more information on the reduced AFSP requirements for CRTPs, please click on the link below:

|

How many CE credit hours do you need for the IRS AFSP? |

||

|

|

PTIN-holder without a tax credential |

CTEC-registered tax professional (CRTP) |

|

Needs 10-hour Federal Tax Law course? |

Yes (+10) |

Yes (+10) |

|

Needs 2-hour Ethics course? |

Yes (+2) |

Yes (+2) |

|

Needs 3-hour Federal Update course? |

No |

Yes (+3) |

|

Needs 6-hour AFTR course? |

Yes (+6) |

No |

|

Needs 5-hour State Tax Law course? |

Not applicable to federal AFSP |

Not applicable to federal AFSP (but CTEC does require a 5-hour California course) |

|

Total CE hours needed for IRS AFSP benefits |

= 18 CE hours |

= 15 CE hours |

The CE program you complete with us will award 15 credit hours toward the AFSP, which is the appropriate amount of CE for CRTPs. If the IRS asks you to complete the AFTR course and 18 hours for the AFSP, then it is very likely that your CTEC credential is not being recognized by the PTIN system.

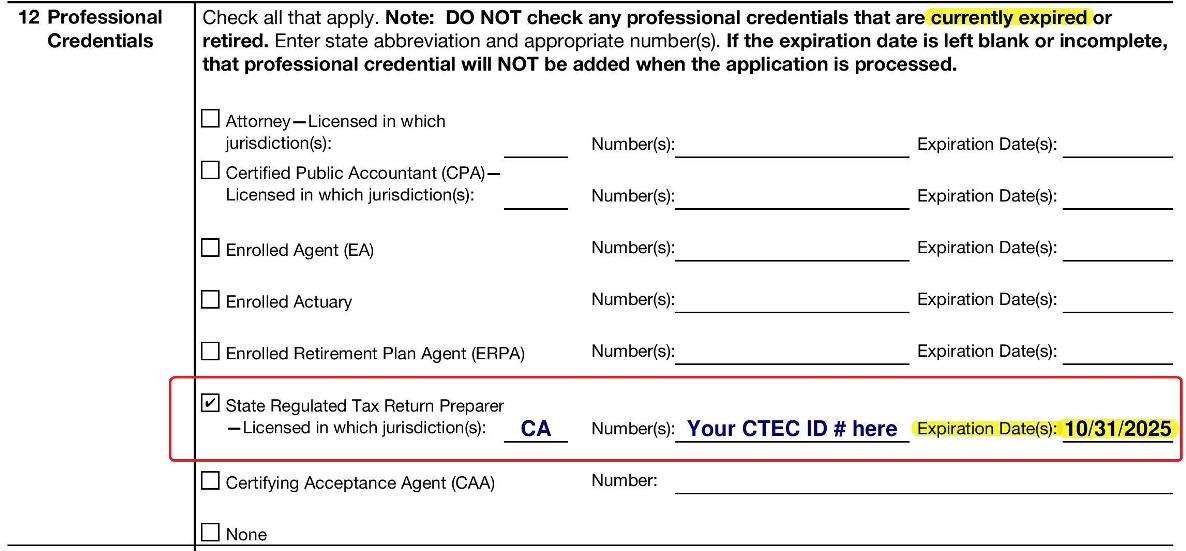

How Does the IRS Know That an AFSP Participant is a CRTP?

PTIN accounts and applications contain a section where the IRS asks for “Professional Credentials.” When the entries in this section are incomplete, out-of-date, or not verified by the relevant licensing body, the IRS will assume the PTIN-holder is a NON-CREDENTIALED tax preparer who needs to complete the AFTR course and 18 hours for the AFSP.

To add or update a credential, log in to your PTIN account. After logging in, you will be on the main menu of your PTIN account. Click on the "Edit Account Information" link. In the "Edit Account Information" section, click "Edit" next to "Professional Credentials." Your CTEC credential should be listed in the row for state-regulated tax return preparer. On that row, enter "California," your CTEC ID number, and the credential expiration date. Make sure that the expiration date is 10/31/2026. Save the new or updated credential.

The IRS and CTEC have jointly devised a method of verifying, confirming, or "authenticating" a PTIN-holder's CTEC credential status. The PTIN system communicates with the CTEC system on a monthly basis to authenticate credentials, so please be patient. When the PTIN system recognizes your CTEC credential, the message claiming that you need more education will go away.

If you need expert assistance with your PTIN account, please consider calling the PTIN Helpline at 877-613-7846 (M-F 6am to 3pm). IRS customer service representatives have full access to your PTIN account – including the “Professional Credential” section – so they are better positioned to help you in this matter.